This blog will explain AEPS, what it is, AEPS as well as how AEPS operates. While other countries economies are struggling to recover, India’s economy has strengthened by achieving a recovery in U-shape. Last month’s war between Russia and Ukraine has also not impacted the Indian economy.

And India is moving ahead with economic growth of 7% to 8%. Now the next goal for India is to achieve China’s economic growth, for which India will have to achieve double-digit growth. But to achieve double-digit growth, India can not progress only by developing cities. For this, India will also need to improve its villages’ economy and social life to move forward quickly.

Why Was The Need For AEPS Felt?

The biggest problem facing India’s development journey was the inability of banking and financial services to reach the villages in the country. Due to this, it could not include a considerable amount of money in the banking system. In such a situation, the Reserve Bank of India directed NPCI to create a system that can provide banking services in those areas of India where there is no banking service, or it is very nominal. The NPCI started the AEPS service based on the instructions of the Reserve Bank.

Full-Form of AEPS

AEPS is Aadhaar Enabled Payment System.

AEPS definition in Hindi

AEPS in Hindi means Aadhaar Saksham Bhugataan Pranaalee

What Is AEPS?

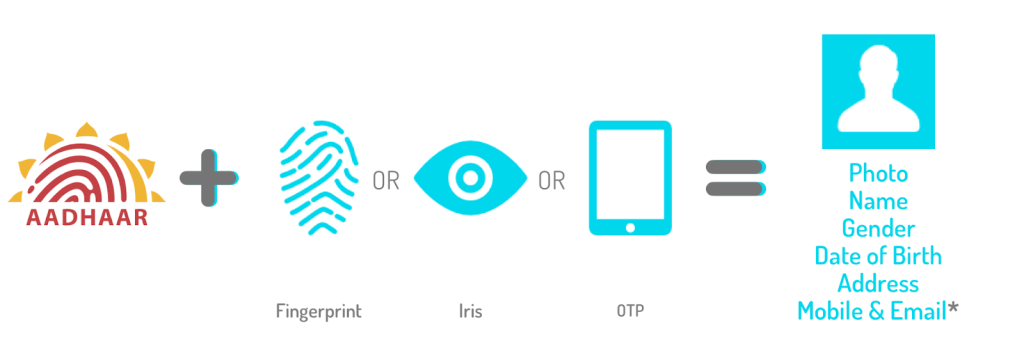

The National Payment Corporation of India has made AEPS, and AEPS is a bank-guided model to facilitate consumer financial transactions through POS (Micro ATM) based on their Aadhaar numbers and fingerprints. This service is specially designed for rural areas. This facility does not need to go to the bank, and individuals can quickly receive and send money from one bank account to another without revealing their bank number.

When Was AEPS Created?

The AEPS service will start in the year 2020. In its journey of 12 years, the AEPS service has made the lives of the villagers easy. Today, they have also been able to connect the mainstream of development by getting a banking service facility in the village.

Who Can Avail Of The AEPS Service?

The AEPS service is based on Aadhar, so the most important thing is to have an Aadhar card. Anyone with an Aadhar card can do banking transactions through the AEPS service, but it is necessary to link that person’s Aadhar with his bank account.

Services Offered By AEPS

Let us know which services are available through AEPS –

Can Pay In Cash

If some work comes up and there is no cash in the house, urban people can withdraw money by going to the ATM. But this was a big problem in the villages, so now the facility of withdrawing money based on Aadhaar numbers and fingerprints through the AEPS service has solved the people’s issues in rural areas.

Cash Deposit

Now people do not need to go to the bank to deposit money and They can deposit their money at the nearby AEPS store and can save their precious time.

Bank Account Balance Information

Through the Aadhaar-based payment service, now any person can get information about the balance of a bank account based on their Aadhaar number and fingerprint.

Mini Statement

Anyone can also use the AEPS service to obtain information about transactions made in the bank in the previous few months.

Aadhar To Aadhar Fund Transfer

Through the AEPS service, a person can now transfer money from his aadhar number to another person’s aadhar number. For this, he does not need to register his bank account certification.

BHIM Aadhar Pay

Any person with an Aadhar number can pay with BHIM Aadhar Pay for any goods or services.

The AEPS Service Provides Some Other Facilities.

Let’s Know About e-KYC

Best Fingerprint Recognition

Demo Certification

Tokenization

Aadhar Seeding Status

The Goal Of Developing The AEPS Service

To lay the foundation for Aadhaar-based banking services.

To deliver banking services to rural areas.

To make banking services more accessible using the Aadhaar number.

It makes banking services secure and easy.

To meet the goal of digitising the payment system.

For getting social security, NREGA, pensions for the elderly, and pensions for people with disabilities to the right people on time.

Benefits Of AEPS Service

This feature is easy to use.

The process is entirely safe.

Facilitate coordination of transactions across various banks.

Transactions through AEPS require only an Aadhar number and biometric identification.

All bank account holders through the AEPS service.

You can access your bank account with Aadhaar Authentication.

You can quickly obtain help from all government schemes through the AEPS service.

How To Use The Customer AEPS Service?

It is straightforward to use the AEPS service.

Let Us Know How You Can Use The AEPS Service

To use the AEPS service, the customer should visit the Paydeer Retail Store.

Inform the Paydeer Retailer of your Aadhaar number as well as the bank name.

Select the type of service the customer wants to get from AEPS.

Prove your identity with your fingerprint and eye scan.

How Much Is The Maximum Amount Of AEPS’s Fund Transfer?

All banks have set different limits for the AEPS service. This limit is between 5,000 to 50,000.

What Is The Charge To Use The Service Of AEPS?

For the AEPS service, the consumer does not have to pay any charge.

What Are The Benefits To The Retailer Of Providing The AEPS Service?

Paydeer retailers can work as mini bankers through the AEPS service.

You can earn a good commission by providing various AEPS services at your retail store.

Easy and quick payment.

Opportunity to work as a mini ATM.

customer service 24*7.

What To Do To Get Paydeer AEPS Service?

Paydeer is a fintech company providing financial and banking services across the country. Paydeer has made its distributors and retail stores across the country, especially in rural areas, its services prominent.

The purpose of Paydeer is to provide banking services to people digitally, which they are becoming increasingly successful. Register on Paydeer online portal to get the Paydeer AEPS service. After this, you will be called by Paydeer and explained the registration process Paydeer registration process would also be completed by calling the numbers available on the portal.